Whether we do so consciously or unconsciously, many people are of the view that they should work hard and hold off on enjoying life until retirement.

17 years ago when I completed law school and got my first job as a corporate lawyer, a financial advisor approached me about retirement planning and investments.

When we sat together to talk, he emphasized the importance of allocating a portion of my income towards retirement from day 1 so that by the time I got to retirement age, I wouldn’t have to worry about how I would survive.

Then of course, he educated me on the magic of compound interest and explained how my retirement funds would be grown through compounding. This seemed like sensible financial advice to me and I made a commitment after that meeting to make retirement planning and savings a number one priority for the duration of my professional career.

At the time, this meant to me that I would need to work very hard over the ensuing years and postpone the pleasures of life so that I would amass savings and have a comfortable nest egg at retirement.

Often times when you have conversations with professionals, a staggering percentage of them will have similar retirement strategies in mind. They will make it clear that they plan on toiling away relentlessly over the next few years so that they’ll have enough to support them throughout their retirement years and to enable them to relax, travel and have fun.

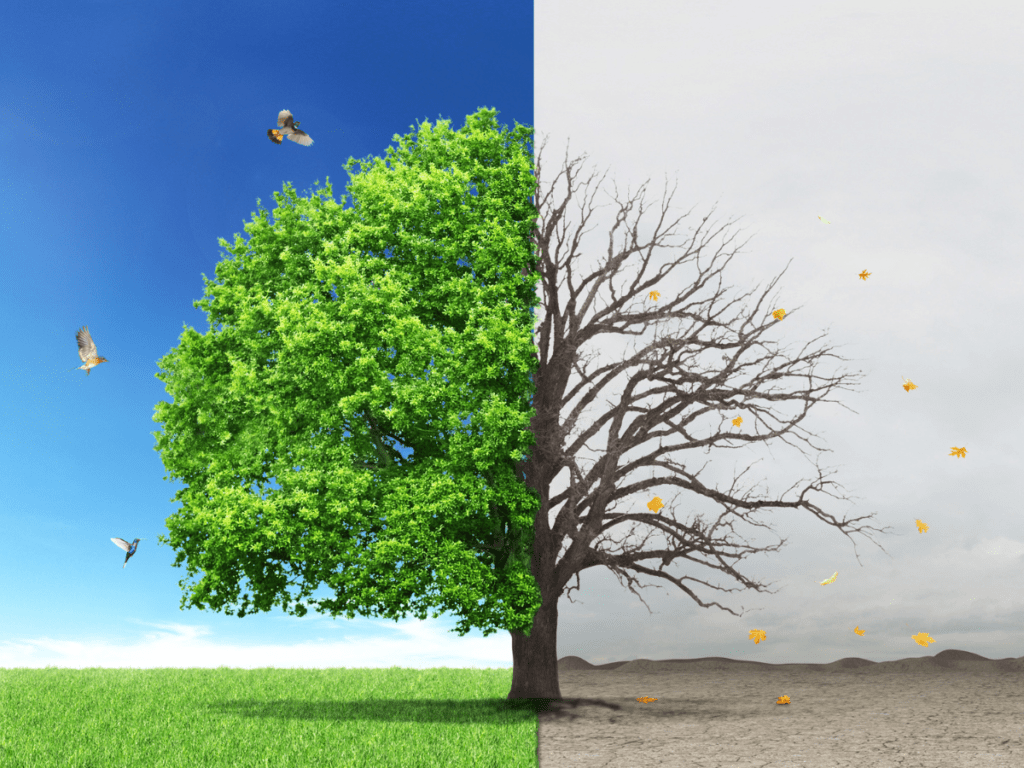

While it is absolutely important to save money and invest regularly, making retirement a lifelong primary goal can have its downsides. Retired professionals will tell you that by the time retirement arrives, they might be elated at first at the sheer thought of not having to get up out of bed to go to work and having a pension coming in every month but eventually they find themselves being disappointed, lost and bored.

Author Richard Eisenburg in his article on retirement, wrote:

"One vexing problem many retirees face: boredom. A 2019 survey by the British National Citizens Service mentoring group found that the average retiree grows bored after just one year."

What a huge letdown! You’ve worked so hard to reach the “promised land”, made huge sacrifices, postponed numerous opportunities to bring joy and fun to your life and here you are at retirement feeling bewildered and disappointed.

So here’s the thing: when we spend months and months, years and years working like a horse with the belief that life isn’t great right now but it will suddenly get better after we retire; the sad reality is that it might not happen.

The truth is that over the years we have formed the habit of thinking about life in this way and this habit will not come to a sudden halt once we retire.

The way to counter this dilemma is to stop being inert passengers on the road to retirement and simply start living your best life right now – yes, this minute rather than delaying it until the future. Here are a couple good reasons you should.

1. Missing Out – Life is too Short

I’m sure you’ve heard people say: “When I retire, I’m going to have the time of my life” or “I can’t wait to reach retirement so that I can finally get to do all the things on my bucket list”.

But what if you never make it to retirement? What if your life is suddenly taken away from you? I know that this sounds a bit morbid but for years I worked for a large insurance company and during that time, I saw hundreds of reports of fatalities; people dying before getting the chance to experience a good life. For me this was a wake up call that I needed to seize every opportunity I could to make the best of life.

While you are still healthy and able, try to tackle your bucket list in bite-sized pieces. This means that if you have 2 weeks vacation, travel to a country you’ve always wanted to visit, have a day at the spa, treat yourself to a haircut, visit a local attraction, go on an excursion you’ve always dreamed of, learn to dance, enjoy a cruise or join that club you’ve been meaning to join.

Due to your financial commitments such as mortgages, putting your children through school or taking care of an elderly parent, it might not be possible to do everything on your wish list all at once or to participate in lavish activities.

2. Enjoy Life While You are Still Healthy

Who’s to say you will be healthy and fit enough to enjoy life after you reach retirement age. Typically, as we get older the body slows down and we start feeling aches and pains in places we never imagined (unless you are a fitness buff).

We also find it increasingly difficult to do the things on our bucket list such as traveling the world, hiking or walking around as a tourist viewing sights.

With the numerous flights and airport delays that have been occurring due to COVID, traveling has even become increasingly taxing on the body. You find yourself standing in long lines in airports or having to wait around for a flight that is delayed by hours.

It’s for this reason, we should seize every opportunity we have to live our best lives while we are still physically able and not wait until we are too old to do all the things we promised ourselves we would do. According to Forbes author, Robert Laura, one question that you will need to constantly ask yourself is:

“What will I regret if I don’t make it to retirement?” It’s a simple way to become more in the present and ensure you’re striking a balance between living for now versus later."

Living your best life in the moment while saving towards your retirement can be tricky and somewhat conflicting. In order to strike the balance between them, it simply means putting good financial plans in place and setting aside fears about money.

In the wise words of Robert Laura:

"Stop being fearful of using your personal and financial resources to make the best life you can right now. The same stuff that makes for a great retirement can be used now to create a positive and fulfilling life that leads up to it. Now that’s not permission to abandon everything you are doing to live extravagantly, but instead, an opportunity to acknowledge your present situation, needs and opportunities."

What are your views on this topic? Let me know by dropping a comment below.

Author

Monique Abbott

Hi, I ’m Monique, founder and editor-in-chief of Yes2Yolo, travel addict, lover of home makeover projects among many other passions, including creative and inspirational writing to embolden us to live our best lives. At my core, I am a creative artistic being and I believe that creativity knows no end.

…

I’ve explored over 60 countries with my husband Nick. Together we’ve partnered on some truly exciting projects such as creating and running a successful Airbnb business, chairing condo boards, purchasing fixer-uppers and renovating them from scratch on our own while balancing all of this with full-time jobs and family.

…

While my personal passions are travel and home décor, I am, by profession, a lawyer with over 17 years experience.

Very good topic that needs a lot more discussion. The traditional way of thinking is far removed from the minds of my peers and younger. A balanced approach to life is definitely better. Live right throughout your life.

What I am trying to now is to limit my financial obligations as much as possible so I enjoy the years we have here.

I couldn’t agree more Jerome. I think it is a wise move on your part to live as frugally as you possibly can so that you can work less and enjoy life more. Thanks for sharing your thoughts. Much appreciated.

Solid article!.There are no guarantees in life.Retirement isn’t promised.Do what you can now. The present is all we have.

Absolutely Michelle. Very well put! Thanks for the feedback & usual support.