While certainly far from mainstream, the FIRE movement is rapidly gaining traction in many countries, but I’ve yet to find anyone in Jamaica who has even heard of it, let alone is embracing the movement.

FIRE is an acronym for Financial Independence Retire Early, and the adherents have shun traditional values related to retirement age and consumerism to focus on becoming financially independent at a relatively young age.

So why hasn’t Jamaica caught FIRE? What are the specific challenges preventing Jamaicans from embracing FIRE? What can Jamaicans do to have a realistic chance of achieving the FIRE dream? For my answers to these questions, read on.

Table of Contents

I. What is FIRE

The FIRE movement can trace its roots to the 1992 best-seller “Your Money or Your Life” by Vicki Robin and Joe Dominguez. The objective is to become financially independent by living frugally and investing in a regular and focused way.

You need to know your Financial Independence (FI) number, which is calculated from your annual living costs multiplied by 25. If your living costs are JMD4m a year, your FI number is JMD100m or about USD650,000. Once you have that amount, you shouldn’t need to earn money again, provided your lifestyle remains largely unchanged.

This is based on the 4% rule which proposes that we can withdraw 4% of the value of our portfolio over an indefinite period without depleting it. It also assumes an asset mix of 60% stocks and 40% bonds. If it works as promised, you can live off your investments for the rest of your life without ever working to earn money again.

The main issue with the 4% rule is that it only works about 97% of the time due to something called sequence of return risk. In a nutshell, it’s retiring just before a stock market crash, which leaves you with the choice of either delaying retirement or a significant chance of running out of money years too early. The best antidote to this is the Yield Shield devised by Bryce Leung which allows you to withdraw your 4% while protecting your portfolio over the critical first 5 years of your retirement.

II. Jamaican FIRE Challenge # 1 -Low Incomes

The FIRE movement has been criticized by many, including Dave Ramsey, for only working for those with high incomes, such as “tech bros” like Pete Adney who is known as Mr Money Mustache. Obviously the higher your income, the easier it should be to save and invest your money. However, someone who earns JMD5m (USD33k) and who lives off JMD3m (USD20K), will become financially secure long before someone else who earns ten million and spends twelve.

The fact is that there are many who have achieved or who are successfully working towards financial independence despite neither working in high-paying or tech jobs. There is Julien Saunders, an African American former chef from Atlanta and his wife, Kiersten, who like me is a recovering perfectionist. You can also read about the postal worker who has four children and whose husband is a stay-at-home parent.

FIRE is definitely not for those who are unable to meet their most basic needs. However, the hard truth is if you choose to spend even a single dollar on luxuries, you have the potential to reach financial independence, even if it takes you many years longer than it did for the aforementioned Mr Money Mustache.

III. Jamaican FIRE Challenge # 2 – Materialism

I love my country but there is no doubt that Jamaica has become a very materialistic society where some of us feel that our worth is judged by how wealthy and successful we seem to others. This was summed up astutely by the late journalist and Jamaican icon Ian Boyne in a 2012 article in the Jamaica Gleaner. Mr Boyne wrote that Jamaicans won’t give up our cars if we were to have a European style public transit system, as we need our vehicles to show to others that we have “arrived.”

Even if you recognise this truth, it’s all too easy to shrug your shoulders and say what can I do, it’s our culture. But culture is simply regular behaviours. If we prepare and eat a certain food regularly, it becomes part of our culture. In the same way that we can choose to stop eating ackee and saltfish, we can choose to abandon our materialism.

IV. Jamaican FIRE Challenge # 3 – Family Commitments

Most Jamaicans who have achieved a modest degree of financial success are likely to be supporting other family members. Sometimes we do this out of love, more often it’s the result of obligation and guilt. It’s beyond culture, as in Jamaica, adult children are legally required to financially support their parents and grandparents, thanks to Section 10 of the Maintenance Act. Whatever the reason, many of us find ourselves supporting members of our extended family.

Overseas, this is known as the Black Tax, although it’s also common in other cultures, especially in Asia. This is a tricky and emotionally charged issue, and one which I struggle with myself on a daily basis. I have done two things. Firstly, I clearly defined who are my primary, secondary and tertiary financial responsibilities. This has helped me ensure that my limited ability to support my family is directed where it is most needed and to those I care about most.

The second thing I have done is to include family commitments in my monthly budget. This creates a sense of reality for me, reduces the likelihood of me sending additional, unbudgeted money to family members and sets clear expectations for my family in terms of the limit of my ability to support them.

V. Jamaican FIRE Challenge # 4 – Cost of Living

There is no doubt that Jamaica is an expensive place to live. We are a country that has seen our GDP per Capita decline significantly in both real and relative terms since 1972, we rely heavily on imports and the cost of our electrical power is more than double the global average.

This impacts financial independence in two ways: it means we need more funds saved to reach FI and it will take us longer to get there due to the higher costs. This doesn’t mean that financial independence is impossible, just that we have to be more patient and more focused.

VI. Jamaican FIRE Challenge # 5 - Limited Low-Cost Investment Options

If you follow FIRE investment gurus such as JL Collins author of The Simple Path to Wealth, Mr Money Mustache and the Mad Fientist, you will know that the FIRE movement’s investing strategies are built around index-linked ETFs. The reason is two-fold:

- Actively managed funds charge much higher fees than ETFs, which can compound over several years into a major cost against your portfolio; and

- Very few actively managed funds out-perform the market (AKA the index) on a long-term basis.

In other words, they don’t choose to pay more for something that doesn’t provide extra value. Unfortunately, such funds are difficult to access from Jamaica, but all is not lost as there is great, Jamaican specific investing advice available from renowned financial journalist Kalilah Reynolds, who you may have seen on TV or social media.

One huge advantage we do enjoy as residents of Jamaica is the absence of capital gains tax. So, while we are required to pay tax on interest and dividend payments, the growth in the value of the stocks and share we own is not currently taxed.

VII. Your FIRE Step # 1 - Understand Your Money Situation

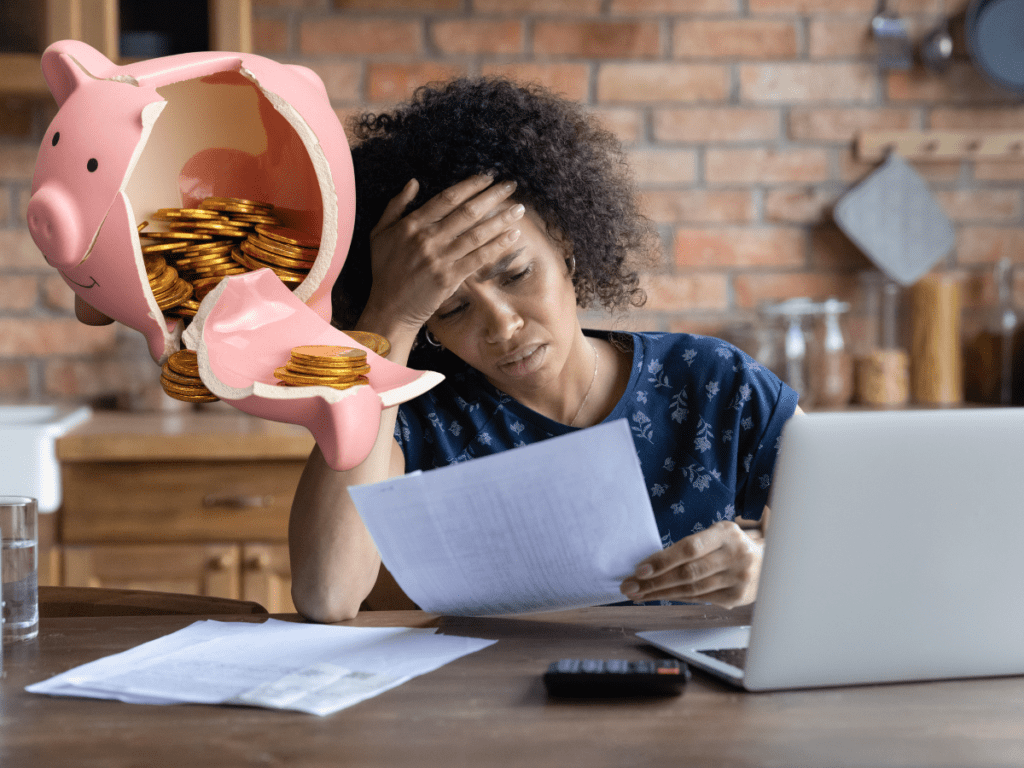

Firstly, you have to get yourself out of debt which my husband Nick addressed in our post Six Steps Along the Simple Path to Happiness.

Unless you are a very high earner, it’s virtually impossible to build wealth if you are servicing expensive debts such as credit card bills and car loans.

You also need to control how you spend your money. Start by tracking every penny you spend using one of the many budget apps available. Do this for at least a month, possibly longer. Then analyse what you have spent, breaking it down into essential expenditure and non-essential expenditure. The keys are to be brutally honest in terms of what is truly essential and then being equally brutal about reducing nonessential expenditure.

I strongly recommend asking a trusted friend from outside your household to help you do this. Their lack of emotional attachment will help, provided that you pick the right friend!

VII. Your FIRE Step # 2 – Get Family Buy-In

Unless you are truly single, with no family commitments, this step is crucial. If you start your journey toward financial independence while your spouse continues to spend on nonessentials, not only will your FIRE journey be extremely tough, but your relationship will probably suffer too.

What’s worse, much of what you save can end up being wasted by your spendthrift partner.

You may have a sudden epiphany about your financial future and want to get started immediately. However, it will likely take significant time and many heartfelt discissions for the others in your household to feel the same way. My suggestion here is to focus conversations on lifestyle and shared dreams and goals rather than money.

Remember money itself isn’t inherently important it’s what money allows you to do that matters. Money is simply a tool like a screwdriver or cooking pot.

IX. Your FIRE Step # 3 – Set Realistic Goals

While hard-core followers of FIRE aim to retire decades before traditional retirement ages, the fact is that the majority continue to work and earn money long after they reach their FI number. Maybe FIRE for you means retiring at 55 or even simply having enough for a comfortable life if you retire in your sixties. These are all great goals.

You can also consider Partial FIRE. This means reaching the point where you can afford to work part-time or give-up your high-stress job for something more rewarding that may pay less.

Your partial FI number is the amount of money you need to leave working for you in your portfolio for a set number of years to allow you to fully retire later. In the meantime, you simply need enough income to fund your regular costs, which doesn’t include the money you previously put aside for investments.

Another option is Temporary FIRE. This is where you have accumulated enough funds to support you and your family for a finite period while you take a break from work.

This can be particularly appealing for younger singles who fancy travelling the world for a couple of years, and those in particularly stressful jobs. You can even combine Partial and Temporary FIRE by taking a lower income role for a set period of time.

Just be sure that you understand the barriers to re-entering your main career. You want to ensure that there will be opportunities for you after spending two years travelling around Southeast Asia.

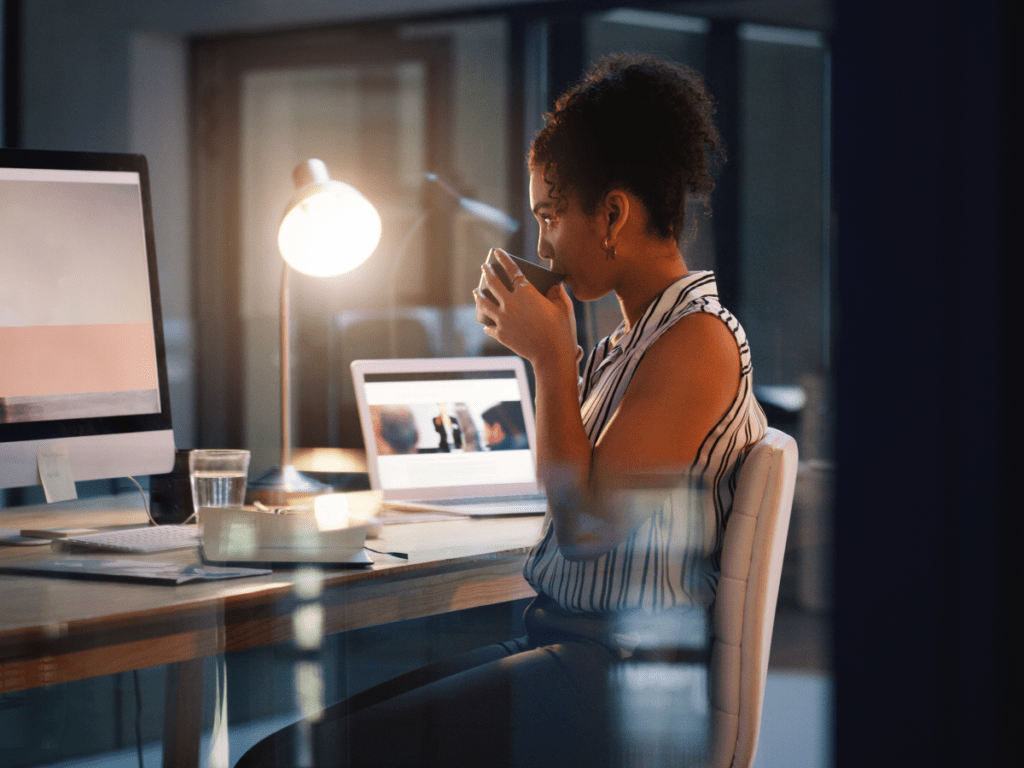

X. Your FIRE Step # 4 – Increase your Income Potential

Until recently, the options for most Jamaicans to increase their income streams were extremely limited. This started changing with the onset of the digital age and accelerated rapidly during the expansion of remote working since the start of the COVID-19 pandemic.

Increasingly organizations are looking for online support from virtual assistants (VAs) and freelancers. If you have any of the in-demand skills, a computer and a decent internet connection, you may be able to find a lucrative option that pays in US dollars or another strong foreign currency.

As Jamaicans, we have an advantage. What might be a low rate of pay overseas may be much more competitive within the Jamaican labour market. I know people who are doing very well as full-time VAs for several clients in the US, while others take on part-time freelance gigs to supplement their primary jobs.

My only caveat is that you need to conduct due diligence. You need to take care that you don’t find yourself being scammed as you try to increase your income stream through online opportunities.

FIRE or Financial Independence Retire Early is another way to live a purposeful life.

When you start on the road towards financial independence, you will find yourself questioning conventional wisdom and focusing your life on what really matters to you. Of course, it’s not easy, but then little of what really matters is.

Do you think FIRE is attainable for people in Jamaica? Is it something that only the top 10% can attain or can those working in more typical occupations dream of FIRE? Drop us a comment below.

DISCLAIMER: This article is for informational purposes only, you should not construe this information or other material as legal, tax, investment, financial, or any other form of advice.

Author

Monique Abbott

Hi, I ’m Monique, founder and editor-in-chief of Yes2Yolo, travel addict, lover of home makeover projects among many other passions, including creative and inspirational writing to embolden us to live our best lives. At my core, I am a creative artistic being and I believe that creativity knows no end.

…

I’ve explored over 60 countries with my husband Nick. Together we’ve partnered on some truly exciting projects such as creating and running a successful Airbnb business, chairing condo boards, purchasing fixer-uppers and renovating them from scratch on our own while balancing all of this with full-time jobs and family.

…

While my personal passions are travel and home décor, I am, by profession, a lawyer with over 17 years experience.